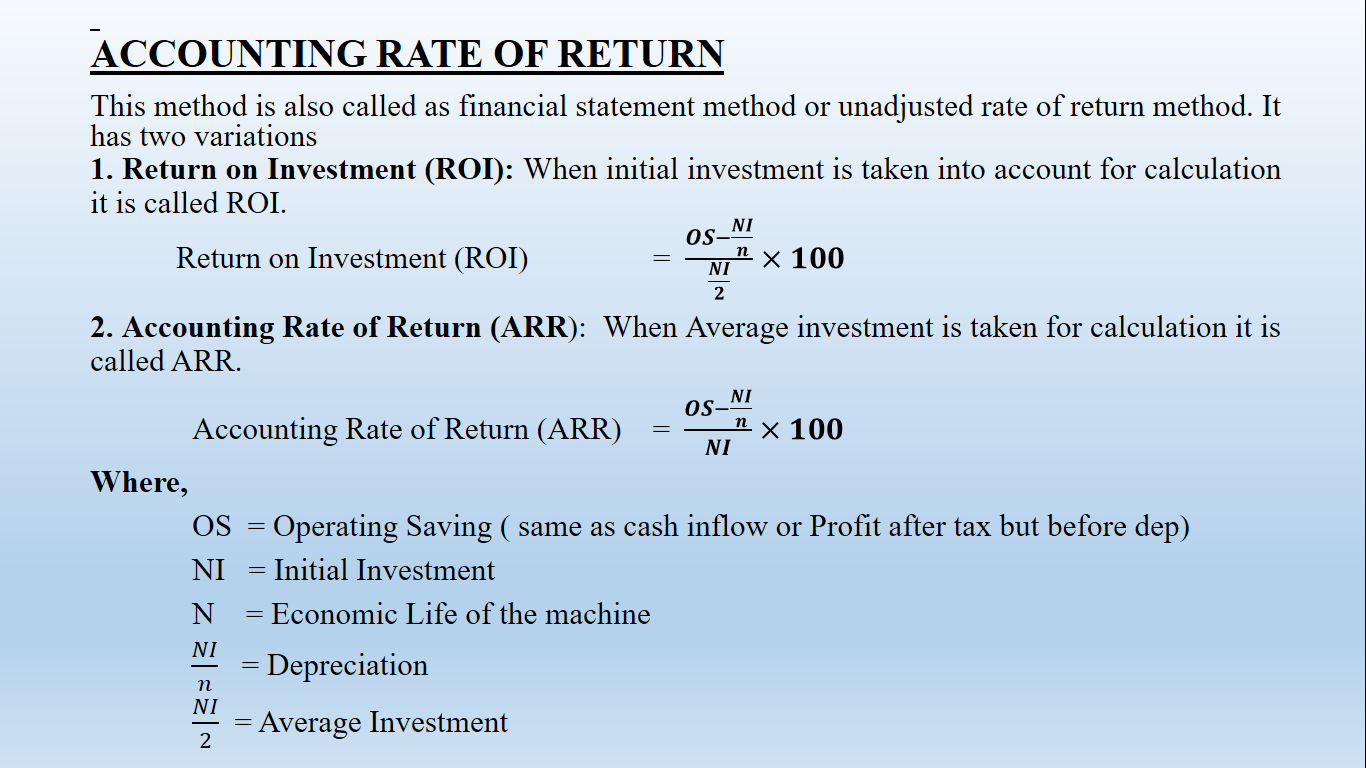

Accounting rate of return method is also called financial statement method or unadjusted rate of return method.

Decision Criteria

- In case of many projects, a project with higher ARR or NOI will be selected.

- In case of only one project, it would be selected if it earns more than companies predetermined required rate of return.

Advantages of Accounting Rate of Return Method

- It is simple and easy to calculate.

- It takes into account all the savings over the entire period of economic life of the investment.

- It is based on accounting profit rather than cash inflow. Accounting profit can be easily obtained from financial statements.

- It measures the benefit in percentage which makes it easier to compare with other projects.

- This method helps to distinguish between projects, where the timing of savings is approximately the same.

Disadvantages of Accounting Rate of Return Method

- This method ignores the time value of money.

- This method is based on accounting profits rather than cash flows. In order to maximize the wealth of shareholders, cash flows should be taken for calculation

- This method ignores the size of investment. Sometimes ARR may be the same for different projects but some of them may involve huge cash flows.