Part of profit which is not distributed as dividend is retained earnings. Unlike debt and equity, there is no obligation to pay any return on retained earnings. So, we can say that there is no cost of retained earnings.

But it is not so. From shareholder’s point of view, the retained earnings do have some cost. if that amount was not retained, the shareholder would have received that as dividend. He would have invested such amount in some other investment and would have earned some profit from them. Thus, we could say that cost of retained earnings is an opportunity cost. The company should earn a minimum return which the shareholder would have earned, if he had invested such amount elsewhere.

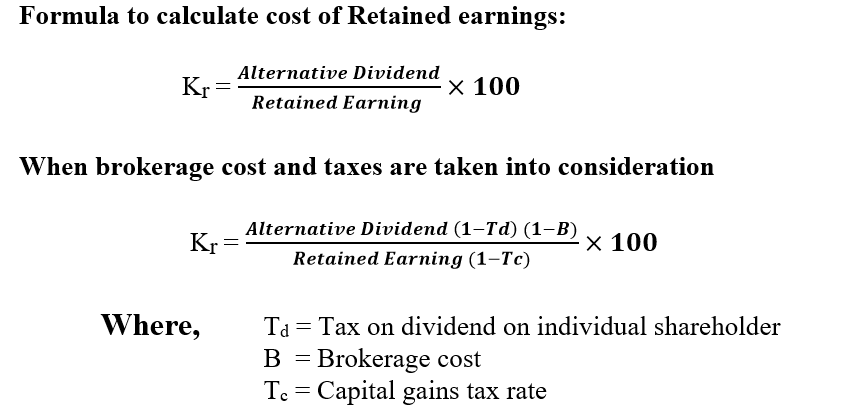

Formula to calculate cost of Retained earnings:

Where, Td = Tax on dividend on individual shareholder

B = Brokerage cost

Tc = Capital gains tax rate

If we look in a different perspective, retained earnings is a part of profit and belongs solely to equity shareholders. Thus, it is assumed that cost of retained earnings is same as cost of equity.

In this way,

Kr = Ke

When brokerage cos and taxes are taken into consideration

Kr = Ke (1-Td) (1-B)