M.J. Gordon also holds that dividend is relevant to the value of the company and dividend policy certainly affects the value of the company i.e. marker price of shares. According to Gordon, the market value of share is equal to the present value of future stream of dividends.

Assumptions of Gordon’s model

- Only retained earnings are used to finance investment opportunities.

- The firm is an all equity firm. No external financing is available.

- The company’s internal rate of return (r) and cost of capital (k) is constant.

- The company has very long and perpetual life.

- Corporate tax does not exist.

- The retention ratio once decided is taken as constant. Thus growth rate g = br is also constant.

- cost of capital (k) is greater than growth rate (g = br)

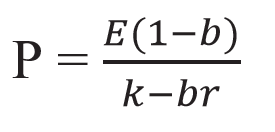

GORDON’S FARMULA

Where,

P = Market Price of Share, E = Earning Per Share, b = retention ratio, k = Cost of Capital br = growth rate

It can be summarised as follows

| Growth Firm R > K | The company should retain more and pay less dividend | P increases with increase in retention ratio |

| Normal Firms R = K | Indifferent | Indifferent |

| Declining Firms R < K | The company should be retained less and pay high dividend | P decreases with increase in retention ratio |

Criticisms of Gordon’s Model

- Gordon model assumes that there is no debt and equity

finance used by the firm. It is

not applicable to present day business. - K and r cannot be constant in the real practice.

- According to Gordon’s model, there are no tax paid by the firm. It is not practically applicable.