Meaning of Leverage

The term leverage refers to an increased means of accomplishing some purpose. Leverage is used to lifting heavy objects, which may not be otherwise possible. In the financial point of view, leverage refers to the ability to use fixed cost assets or funds to increase the returns to shareholders.

Generally, increases in leverage results in increased returns and risk; and decreases in leverage results in decrease in returns and risk. The amount of leverage in the firm’s capital structure (the mix of long-term debt and equity) can significantly affect its value by affecting returns and risks.

Definition of Leverage

James Horne has defined leverage as,

“the employment of an asset or fund for which the firm pays a fixed cost or fixed return.”

According to professor M.C. Kuchhal

“Leverage may be defined as meeting a fixed cost or paying a fixed return for employing resources or funds.”

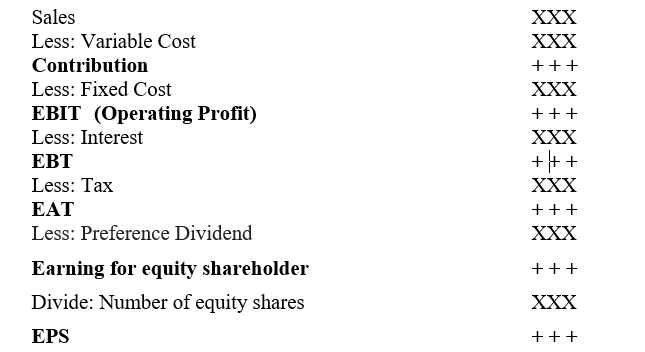

To understand the concept of leverage it is essential to remember the following income statement