Who gave the theory of the Net Income Approach?

David Durant gave the theory of Net Income.

What is the crux of argument of the Net Income Approach ?

According to this approach, the value of a company is affected by its capital structure and cost of capital.

According to this approach, the increase in the proportion of debt capital in the capital structure brings a decrease in overall cost of capital because debt is a cheaper Source of finance. The decrease in cost of capital, in turn, increases the value of the firm.

Thus, when the proportion of debt is 100% in capital structure, cost of capital is minimum. And when there is no debt in capital structure, the cost of capital is maximum.

What are the assumptions of Net Income Approach ?

Along with the basic assumptions of Capital Structure Theories, these assumptions specifically apply to Net Income Approach. I have mentioned the basic assumptions of Capital Structure Theories in the previous Post.

- There are no taxes.

- There are only two sources of finance i.e. debt and equity.

- Cost of debt is less than cost of equity.

- The increase in proportion of debt capital in the capital structure do not affect the risk perception of equity shareholders.

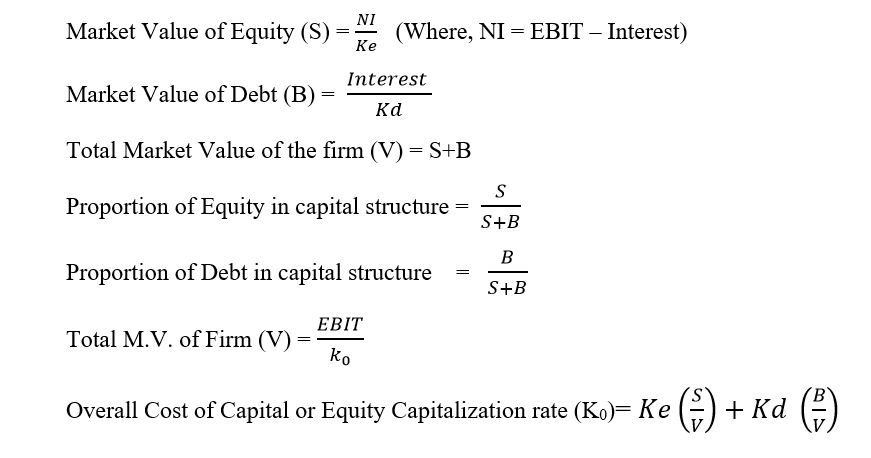

How to solve numerical of Net Income Approach

To solve numericals you need to Understand the following things,

Fishers Ideal Index Number: Calculation, Features and Limitation