This approach is also given by David Durand. This approach is just the opposite of Net Income Approach. According to this approach, there is no relationship between capital structure, cost of capital and values of the firm. The theory holds that change in proportion of debt in the capital structure does not change the overall cost of capital and value of the firm.

Reason: when we increase the proportion of debt in the capital structure of the company, the overall cost of capital decreases. But at the same time, the interest burden on the company increases. When interest payments increase, risk perception of the equity shareholders also increases and they start expecting higher returns from the company. This increases the cost of equity capital. Due to this phenomenon, the decrease in cost of capital due to increase in the proportion of debt is offset and overall cost of capital remains same.

Assumptions:

- The change in the proportion of debt capital in the capital structure increase the risk perception of equity shareholders.

- The overall cost of capital remains same for all degrees of debt-equity mix.

- The value of the equity is residual value which is determined by deducting total value of debt from the total value of company.

- There are no corporate taxes.

- Cost of debt does not change.

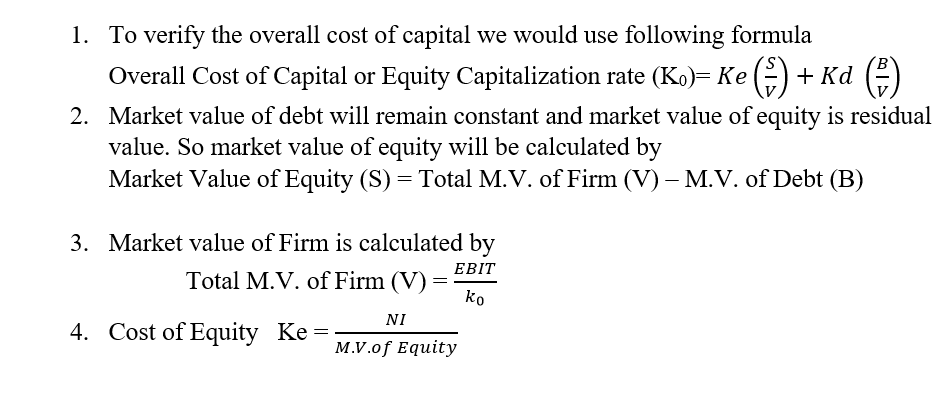

You have to be clear about the following things