Payback Period Method is the simplest and most widely used method. Payback period is the time required to recover the initial investment. A firm is always interested in knowing the amount of time required to recover its investment.

It is based on the concept of cash flow and is a non-discounting technique.

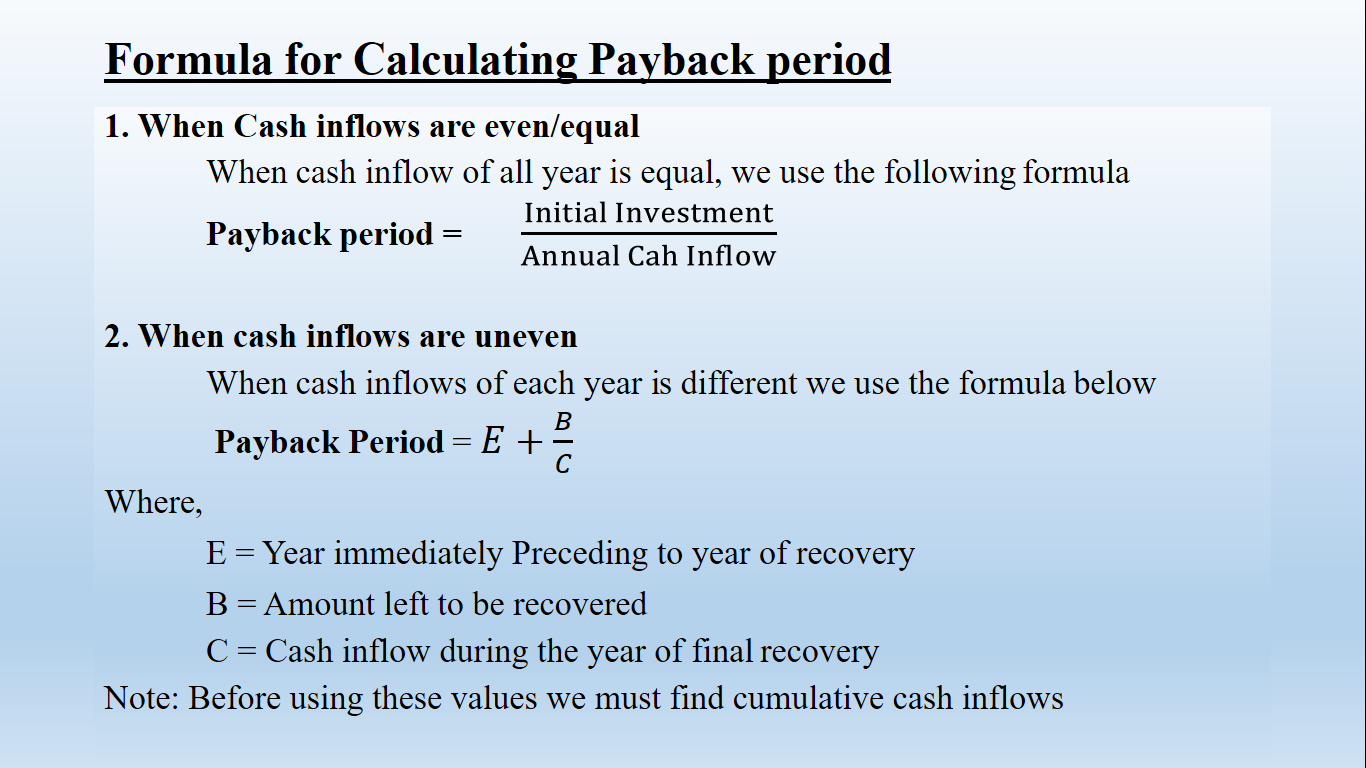

Formula for Payback period

To apply this formula, we have to first calculate the cumulative cash inflows of each year.

Decision Criteria

- In case of competing projects, a project with a lower payback period should be selected.

- If there is only one project in consideration it would be selected only if it has a payback period as per managements expectation.

Merits of Payback Period Method

- It is easy to calculate and simple to understand.

- It is useful in case of those industries where there is a lot of uncertainty and instability because it lays emphasis on the speedy recovery of investment.

- Many firms want to recover their investment as quickly as possible. This method is more appropriate for them to know how quickly they could get their investments back.

- It shows liquidity of the investment.

Demerits of Payback period method

- Neglects cash flows occurring after the payback period: This method does not consider the amount of profit earned after the recovery of the cost of investment. Some projects may have higher cash inflows after the payback period.

- This method does not consider the time value of money.

- This method does not consider the risk associated with the project.

- Post Payback period: The duration in excess of payback period till the economic life of a project.

Post Payback period = Economic life – payback period

- Post Payback Profitability: The amount of profit, which a project could earn after the recovery of initial investment is called as payback profitability.

Post Payback Profitability = Total Earning from project – Payback amount