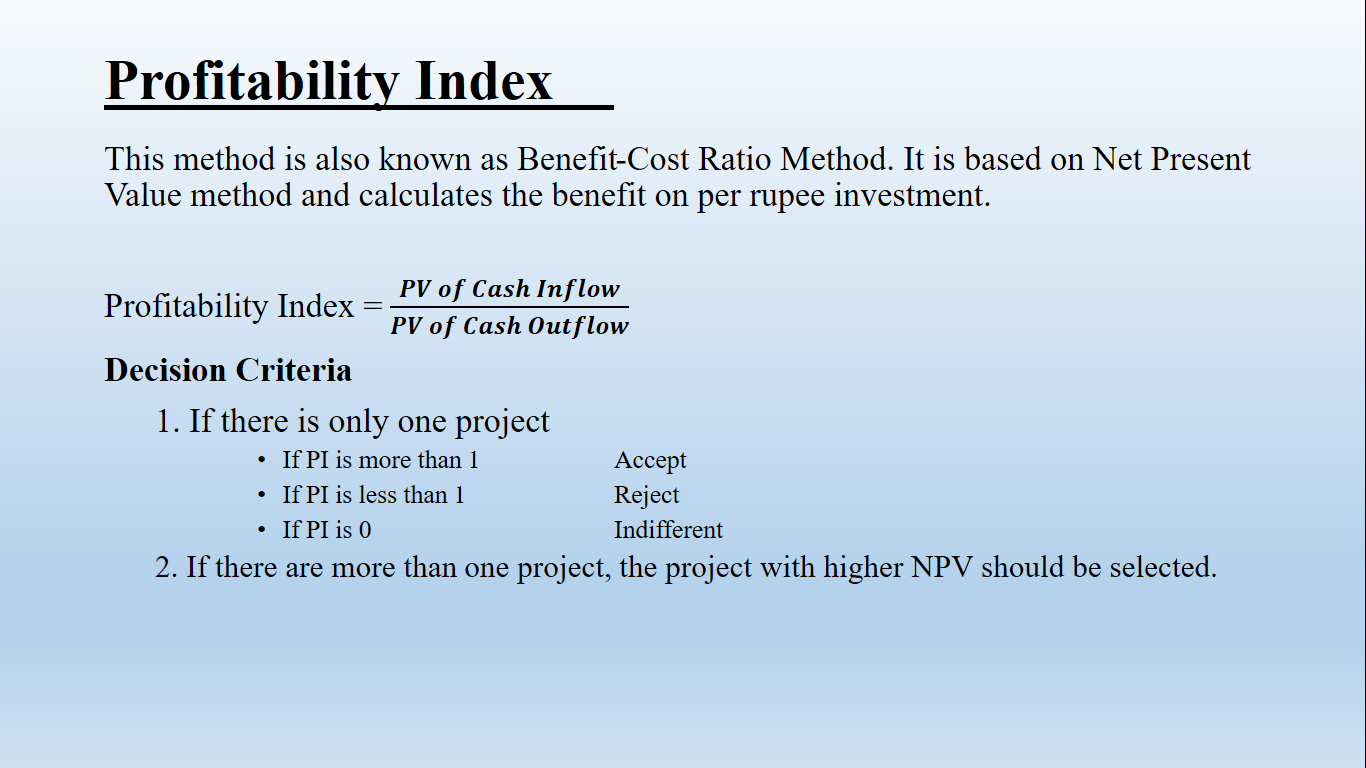

Profitability Index method is also known as Benefit-Cost Ratio Method. It is based on Net Present Value method and calculates the benefit on per rupee investment.

Merits of PI

- It is superior to NPV

- It gives due consideration to the time value of money and cost involved in the project.

- PI techniques give better result in case of projects having different outlays.

- In PI all cash flows are considered including working capital used and released, salvage value is also considered.

- This method is considered best for wealth maximization of shareholders as it is based on cash inflow rather than accounting profit.

- It considers total benefits arising out of project till the end of the

- The discount rate applied for discounting the cash flows is actually the minimum required rate of return. This minimum rate of return incorporates both the pure return as well as the premium required to set-off the risk.

Demerits of PI

- It is more difficult to understand.

- It requires computation of required rate of return to be used as discount