According to Walter, the choice of the dividend policy almost always affects the value of the company. According to him, the dividend policy of the companies must be framed by keeping in mind the availability of new investment opportunities.

If the company has abundant profitable investment opportunities, no cash dividends should he paid because retained earnings will be a source of fund for such investment. On the other hand, if there are no profitable investment opportunities available, a hundred per cent of earning should be distributed as dividend. For the situation between these two extremes, dividend payment will be between zero and a hundred.

Walters model is based on the following assumptions

- All investments are financed through retained earnings.

- The company’s internal rate of return (r) and the cost of capital (k) is constant.

- All earnings are either reinvested internally or distributed as dividend

- There is no change in key factors like EPS and DPS

- The company has a very long and perpetual life.

- The market value of a share is affected by the present value of future dividends.

- Retained earnings in the business affect the expected future dividend and this, in turn, affect the market value of a share.

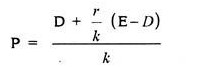

Formula given by Walter is as under

Where,

D = Dividend Per Share, r = Internal Rate of Rate, k = Cost of Capital E = Earnings Per Share

Walter identified three kinds of firm

1. Growth Firms: (R>K): The firms having R>K may be referred to as growth firms.These firms have investment opportunities and they can earn a return which is more than what shareholders could earn on their own. So optimum payout ratio for growth firm is 0% .

2. Normal Firms (R = K): If R is equal to K the firm is known as a normal firm. These firms do not have unlimited profitable investment opportunities and they can earn a rate of return which is equal to that of shareholders. In this case dividend policy will not have any influence on the price per share. So there is nothing like optimum. payout ratio for a normal firm. All the payout ratios are optimum.

3. Declining Firms (R<K): If the company has no profitable investment opportunities and the company earns a return which is less than, what the shareholders can earn on their investments, it is known as a declining firm. Here it should not make any sense to retain the earnings. So entire earnings optimum payout ratio for declining firms is 100%. So according to Walter, the optimum payout ratio is either 0% (when R>K) or 100% (when R<K)

This can be tabulated as follows:

| Growth Firm R > K | Entire earning should be retained (Zero payouts) | P increases with a decrease in the payout ratio. So, P will be maximum when the dividend is zero. |

| Normal Firms R = K | Indifferent | Indifferent. |

| Declining Firms R < K | Entire earning should be distributed ( 100% payout) | P decreases with an increase in the payout ratio. So, P will be minimum when a dividend is hundred per cent. |