Cost of debt refers to the cost which a company has to bear for using fixed interest bearing securities such as debentures, long-term loans and bonds etc. it is mainly associated with debenture.

It has two types

- Cost of redeemable debt or perpetual debt: perpetual debt refers to issue of debentures which will not be redeemed during the lifetime of the company. We use the following formula to calculate the cost of redeemable debt or perpetual debt

Kd = I/SV

Where, Kd = Cost of debt

I = Interest payable

SV = Net proceeds from issue

Calculation of SV (to be used for calculation of both redeemable and irredeemable debt)

- When debentures are issued at par

SV = Par Value – Floatation Charges

- When debentures are issued at discount

SV = Par Value – Discount – Floatation Charges

- When debentures are issued at Premium

SV = Par Value + Premium – Floatation Charges

Note:

- Floatation Charges include Underwriting commission, brokerage, printing expenses etc.

- Suppose par value of one debenture is Rs.100, it means that the company would receive Rs. 100 by selling 1 debenture. While issuing debenture, the company may incur floatation charges or company may give discount. Because, floatation charges and discount are our expenses, it should be deducted from par value.

- In the same way, premium is added to our proceeds because it’s a gain for the company.

Cost of Irredeemable Debenture

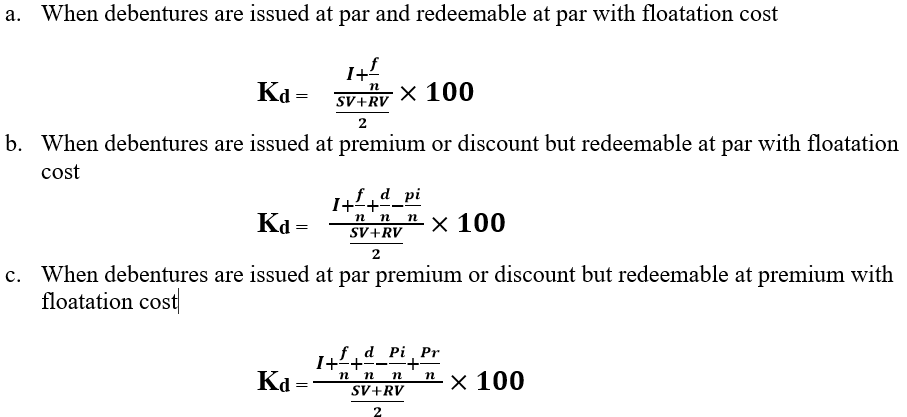

Redeemable debentures are payable after a specified duration. These debentures could also be issued at par, discount or premium.

Where, Kd =Cost of debt

I =Interest payable

SV =Net proceeds from issue

RV =Redemption Value

f =Floatation cost

d =Discount

pi =Premium on issue

pr =Premium on redemption

n =Number of years

Tax Implication

Since debentures is an allowed expenditure for the purpose of income tax. It provides tax saving on the amount of interest payable in the ratio of tax-rate. The cost calculated by above way is cost before tax and it must be adjusted for such tax savings. The adjusted cost of debt capital is known as cost of debt capital after tax.

Kd (after tax) = Kd

Points to remember while solving Numerical

- If face value is not given in the question, it should be taken as 100.

- In case of redeemable debenture, discount, premium or floatation charges must be divided with number of years.

- In the formula, we have taken all expenses Interest, floatation charges, discount, premium on redemption in the numerator.

- Premium on issue(pi) is a gain for company, so we have deducted that amount from numerator, where all item is related with expenses.

- If there is any premium on redemption, Redemption value must also be adjusted for such premium.

Cost of Preference Share

- Cost of preference share is same as cost of debt.

- We would use same formula of Kd but in place of I (Interest), we would use Pd ( Preference Dividend) in the formula.

- Other difference is regarding tax implication.