According to MM, under a perfect market condition, the dividend policy of the company is irrelevant and it does not affect the value of the firm. According to the theory, the value of a firm depends solely on its earnings power resulting from the investment policy.

“Under conditions of a perfect market, rational investors, absence of tax discrimination between dividend income and capital appreciation, given the firm’s investment policy, its dividend policy may have no influence on the market price of shares”.

When a firm pays its earnings as dividends, it will have to approach the market for procuring funds to meet a given investment programme. Acquisition of additional capital will dilute the firms share capital which will result in drop in share values. Thus, what the stockholders gain in cash dividends they lose in decreased share values. The market price before and after payment of dividend would be identical and hence the shareholders would be indifferent between dividend and retention of earnings. This suggests that dividend decision is irrelevant. M-M’s argument of irrelevance of dividend remains unchanged whether external funds are obtained by means of share capital or borrowings. This is for the fact that investors are indifferent between debt and equity with respect to leverage and cost of debt is the same as the real cost of equity.

Finally, even under conditions of uncertainty, dividend decision will be of no relevance because of operation of arbitrage. The market value of share of the two firms would be the same if they are identical with respect to business risk, prospective future earnings and investment policies. This is because of rational behaviour of investor who would prefer more wealth to less wealth. The difference in respect of current and future dividend policies cannot influence share values of the two firms.

Assumptions of MM Theory is that

- Capital markets are perfect: Investors are rational. it means that information is available to all investors easily and freely. Investors are free to buy and sell securities. There is no transaction cost. investors can lend and borrow at the same time.

- Dividends. Earnings and capital gains are subject to same tax rates.

- The firm has a fixed investment policy which will remain unchanged in future.

- No risk is there in forecasting income, dividends and prices.

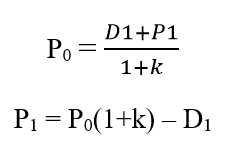

Farmula

Where

P0 = Value of share in the beginning or zero period, P1 = value of share in theend , D1 = Dividend Per share at the end of the period, k = Cost of capital

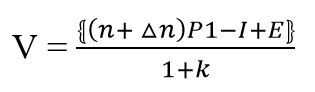

Value of the company may be ascertained as under

n = Number of outstanding shares, I = Total investment, △ n = Additional number of shares, E = earning of the company

Criticism of MM theory

- The assumption that there are no floatation cost is invalid. In practical life whenever fresh issue is made by a company it has to bear floatation cost.

- Another assumption that investors are not subject to transaction cost during sale and purchase of securities, is not valid. In actual, they are subject to transaction cost which affects sale and purchase value.

- Besides equity financing of a new project, a company may have a number of other alternatives which can be used for financing.

- MM’s assumption that taxes do not exist is far from reality. Dividends are not taxed whereas tax is levied on capital gains. So the shareholders may prefer dividend to capital gains.