|

Journey so far Journey so far

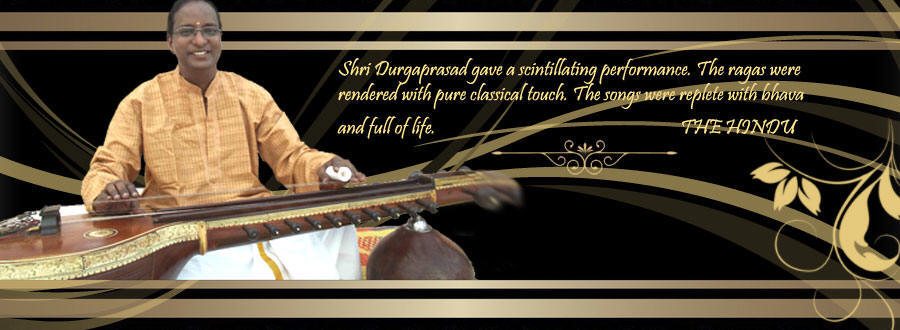

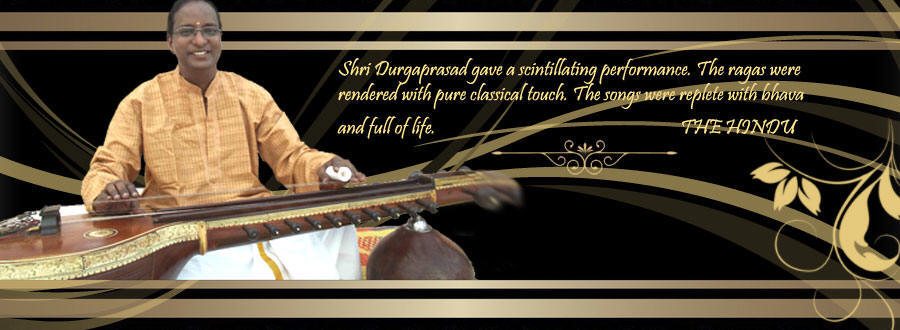

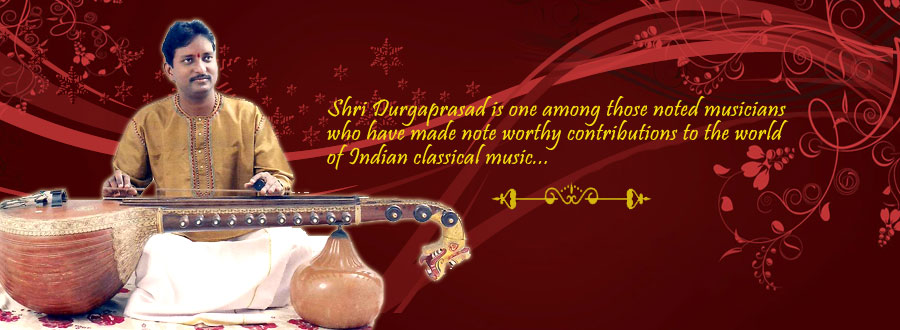

Born in a family of rich musical tradition,

Durgaprasad,

right from

his childhood showed signs of interest in music. His initial musical

training was given by his father late

Shri. ALLAM KOTESWARA RAO

a

renowned Gottuvadyam exponent. Later, he was put under the tutelage

of

KALASIKHAMANI late Shri A.NARAYANA IYER.

By his earnestness,

dedication and devotion to this fine art, he lost no time in

studying the intricacies of handling this instrument and very soon

climbed up the ladder of excellence. He got well trained in Carnatic

Vocal music by the great

SANDHYAVANDANAM SRINIVASARAO.

|

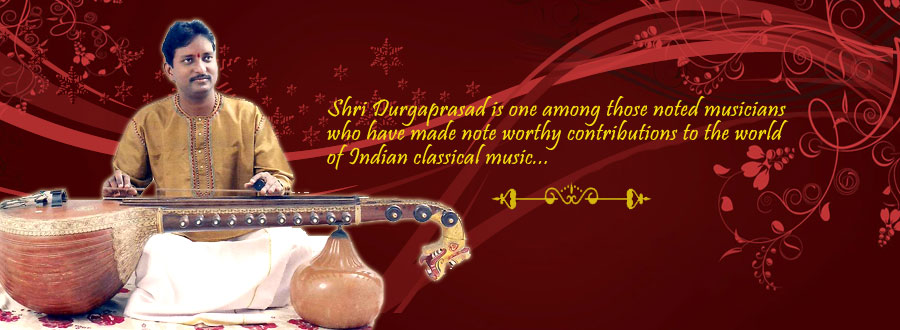

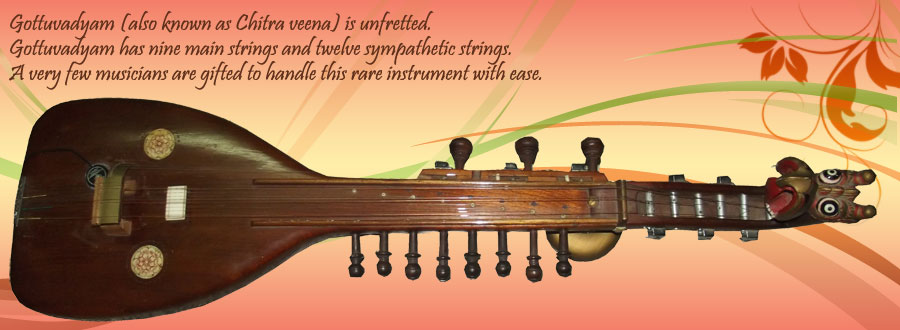

Gottuvadyam

Gottuvadyam

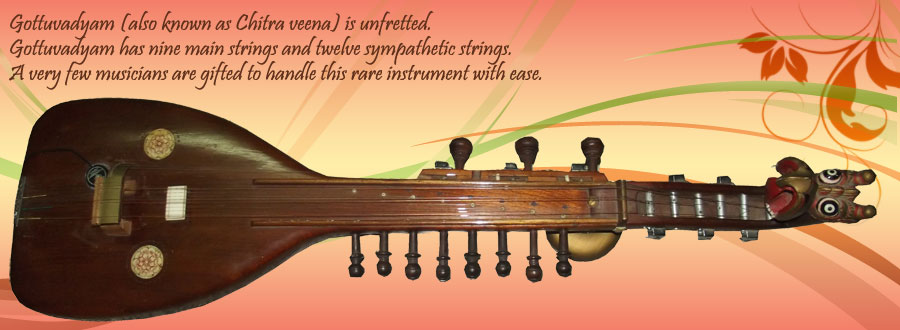

According to ancient classification of Indian string

instruments, Gottuvadyam is also one type of veena. Though both of

them have resemblance, Gottuvadyam (Chitra veena) is

unfretted, where as Veena is fretted. Veena has got only seven

strings, where as Gottuvadyam has nine main strings and twelve

sympathetic strings. It is more difficult to gain mastery over this

instrument, yet capable of bringing out finer nuances if played with

expertise. A very few musicians are gifted to handle this rare

instrument with ease.

Shri Durgaprasad is one among them. |

| |

Awards & Titles:

Awards & Titles:

Sri Durgaprasad has received the following Titles, Awards and

prizes.

• "KALAIMAAMANI" the Tamil Nadu State Government Award for the Year 2006

• "P.Obul Reddy Endowment" 'Certificate of Merit' given by

Narada Gana Sabha in the year 2013.

• "Sangeetha Kala Vpanchee" title conferred by

Vipanchee Academy in the year December 2016

|

|